Taxpayers Save Time, Money in First Year of Direct File in New Jersey

Dave Cole, Chief Innovation Officer

May 8th, 2025

New Jersey’s first year of participation in the IRS Direct File program resulted in residents who participated saving an estimated $1.3 million in filing costs and receiving about $3.2 million in tax refunds. The 100% free tool allowed nearly 8,500 New Jerseyans with simple tax situations to file federal and state tax returns quickly, securely, seamlessly, and with very high satisfaction scores.

New Jersey was one of 25 states that participated in Direct File this year, after a pilot last year that included 12 of those states (not including New Jersey). New Jersey’s Office of Innovation and Division of Taxation created the mobile-friendly tool in partnership with other tax experts, nonprofit Code for America, and residents themselves.

Data Reflect Great Experiences

“With the free IRS Direct File tool, we delivered convenience and cost savings to thousands of New Jerseyans this spring,” said Governor Murphy. “We are thrilled to learn that the vast majority of New Jersey taxpayers who used Direct File found it to be an easier and more efficient process, relieving some of the stress that tax filing season can bring.”

New Jersey tracked customer satisfaction of those who used the tool:

- 96% were satisfied or very satisfied overall

- 95% said the transfer of data from federal to state filing was “seamless and quick”

- 93% said they prefer Direct File over ways they’ve previously filed

- 90% said they would recommend Direct File to others

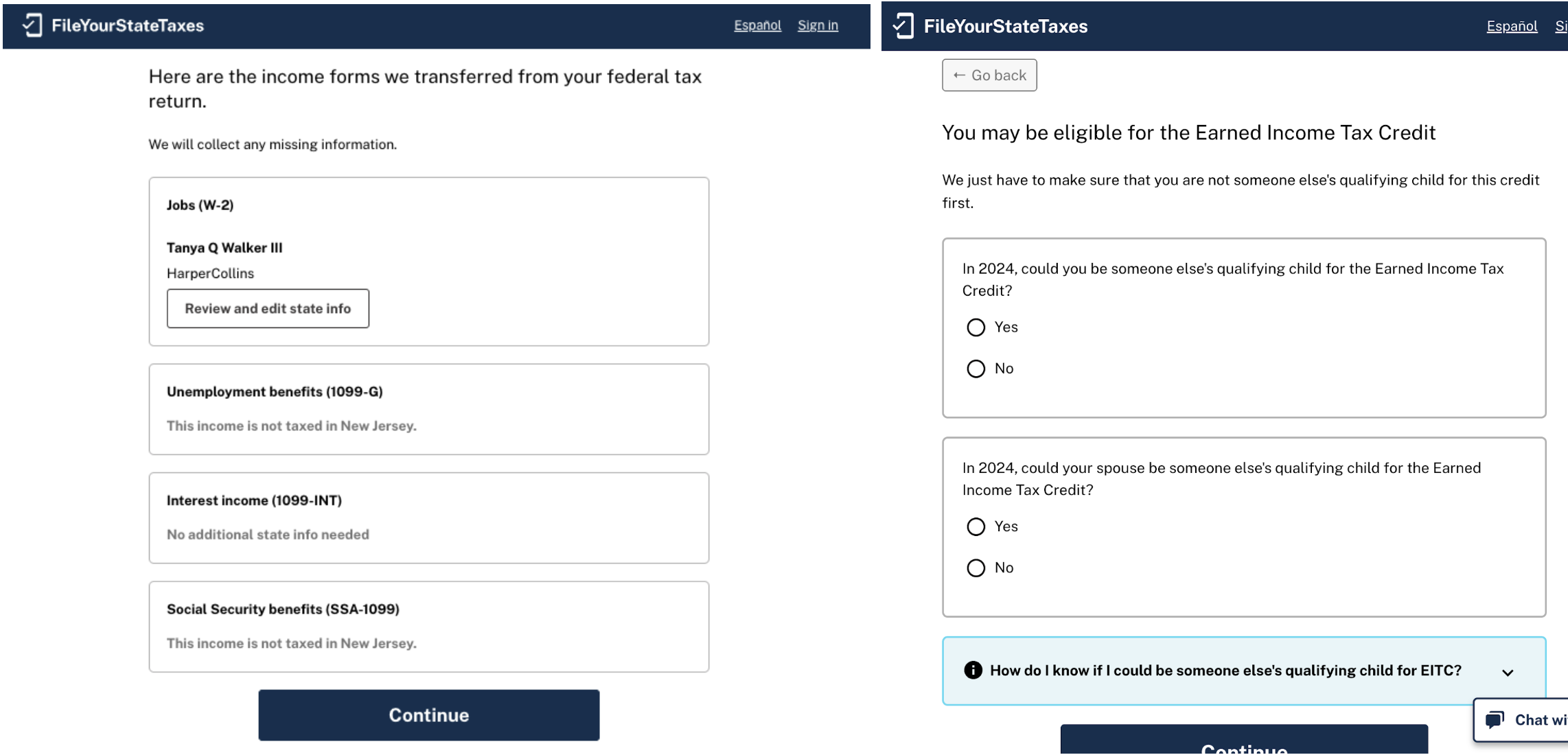

The tool, which remains usable for those with filing extensions, automatically brings over the filer’s federal information to New Jersey’s state return. Data shows that these users could then complete their state return in under just 10 additional minutes, on average, by answering easy-to-understand questions. The tool also helped eligible users automatically claim tax credits such as the Earned Income Tax Credit and Child Tax Credit.

“We’re pleased that so many New Jerseyans had such a positive experience filing their taxes quickly and easily through Direct File, “ said New Jersey Treasurer Elizabeth Maher Muoio. “This was a great example of how collaboration can help make government more streamlined while benefiting taxpayers at the same time.”

Participants Liked Direct File

This year, eligible filers included those who lived in New Jersey for all of 2024, earned all 2024 income in the state, made below certain income thresholds, and used the same filing status for both federal and state income tax returns. The tool was expanded during this year’s filing season to include those with distributions from employer-sponsored pension and retirement accounts.

New Jerseyans who completed the post-filing survey were asked to provide any additional feedback. Their comments were positive, including:

“I’ve used tax software for over 20 years now. This was easy and didn’t cost me anything.” “It’s perfect. I couldn’t believe how easy it was. You saved me over $200 in fees.”

“This saved me money and time. Make it more known!”

“My favorite thing about this site is that I don’t have to fill in so much info because a large majority of it was filled in automatically from my federal return. It does all of the work.”

“Thank you for this wonderful tool. It’s a very simple and easy-to-use tool for someone who doesn’t know much about these processes.”

“It’s a wonderful free application to submit tax returns. I would recommend all to file through this.”

Given the feedback we’ve received, we know that New Jerseyans found Direct File to be an effective and efficient way to file their state and federal taxes, and we are excited to build on this foundation.

Office of Innovation

Office of Innovation